It's Looking Like The TV/Cable Business & Traditional Print Are Starting To Collapse

by Henry Blodget

Don't Mean To Be Alarmist, But The TV Business May Be Starting To Collapse

In the first decade of the commercial Internet--the 1990s and early 2000s--there were frequent murmurings that newspapers were screwed.

The digital audience didn't read newspapers, people pointed out. They visited web sites. They read articles here and there. But they didn't put the stack of articles, photos, and ads known as a "newspaper" on their breakfast table and flip through the whole thing.

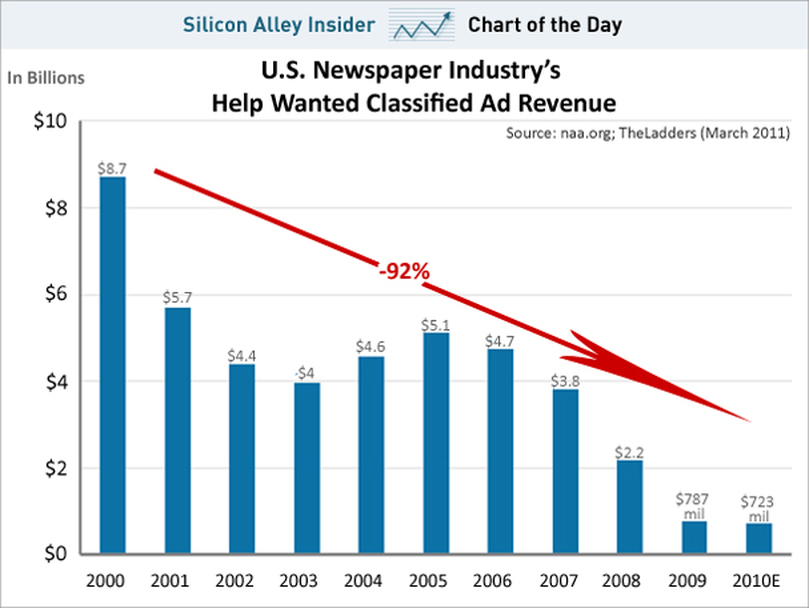

What's more, the digital audience stopped using newspapers as a reference and source for commerce. They browsed on eBay and Craigslist instead of reading classifieds. They got their movie news from movie sites. They got real-estate listings from real-estate sites. They learned about "sales" and other events from email and coupon sites. And so on.

In other words, the user behavior that had supported newspaper companies for a century began to change.

But for almost a whole decade, the newspaper industry barely noticed.

Subscriptions kept going up.

Ads kept going up.

Stocks kept going up.

Those who said that newspapers were screwed were dismissed as clueless doom-mongers, at least by newspaper executives.

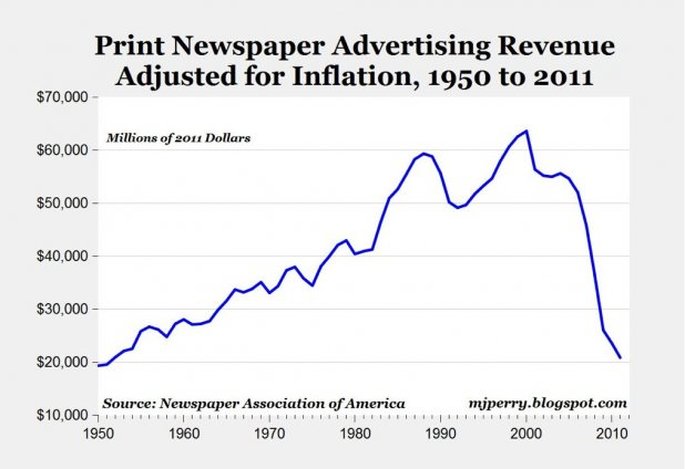

Then this happened:

The digital audience didn't read newspapers, people pointed out. They visited web sites. They read articles here and there. But they didn't put the stack of articles, photos, and ads known as a "newspaper" on their breakfast table and flip through the whole thing.

What's more, the digital audience stopped using newspapers as a reference and source for commerce. They browsed on eBay and Craigslist instead of reading classifieds. They got their movie news from movie sites. They got real-estate listings from real-estate sites. They learned about "sales" and other events from email and coupon sites. And so on.

In other words, the user behavior that had supported newspaper companies for a century began to change.

But for almost a whole decade, the newspaper industry barely noticed.

Subscriptions kept going up.

Ads kept going up.

Stocks kept going up.

Those who said that newspapers were screwed were dismissed as clueless doom-mongers, at least by newspaper executives.

Then this happened:

And lots of newspaper companies went broke or almost went broke. And the stock of The New York Times Company, the country's premiere newspaper, fell from $50 to $6. (See: "The Incredible Shrinking New York Times")

In other words, newspapers were screwed. It just took a while for changing user behavior to really hammer the business.

The same is almost certainly true for television.

In our household, as in many households, television consumption has changed massively over the past decade, especially over the past 5 years.

In other words, in our household, and in many other households like ours, the same thing has happened to the TV business that has happened to the newspaper business:

The user behavior that supported the traditional all-in-one TV "packages"--networks and cable/satellite distributors--has changed.

We still consume some TV content, but we consume it when and where we want it, and we consume it deliberately: In other words, we don't settle down in front of the TV and watch "what's on." And, again with the exception of live sports, we've gotten so used to watching shows and series without ads that ads now seem extraordinarily intrusive and annoying. Our kids see TV ads so rarely that they're actually curious about and confused by them: "What is that? A commercial?"

For now, our type of household may still be in the minority, but we won't be for long. And our type of household is the type of household that many advertisers and TV networks want to reach. We're still in "the demo" (24-55), and we're still buying a lot of stuff.

So, what are the key points of this shift in user behavior for the traditional TV business?

But remember what happened in the newspaper business.

When the Internet arrived, user behavior started to change. It took a decade for this change in behavior to hit the business. But when it hit the business, it hit it hard--and it destroyed it shockingly quickly.

And the same thing seems likely to happen to the TV business. The only questions are:

What is the shift in user behavior likely to do to the TV business?

As for the other question, "when," the answer may be "now."

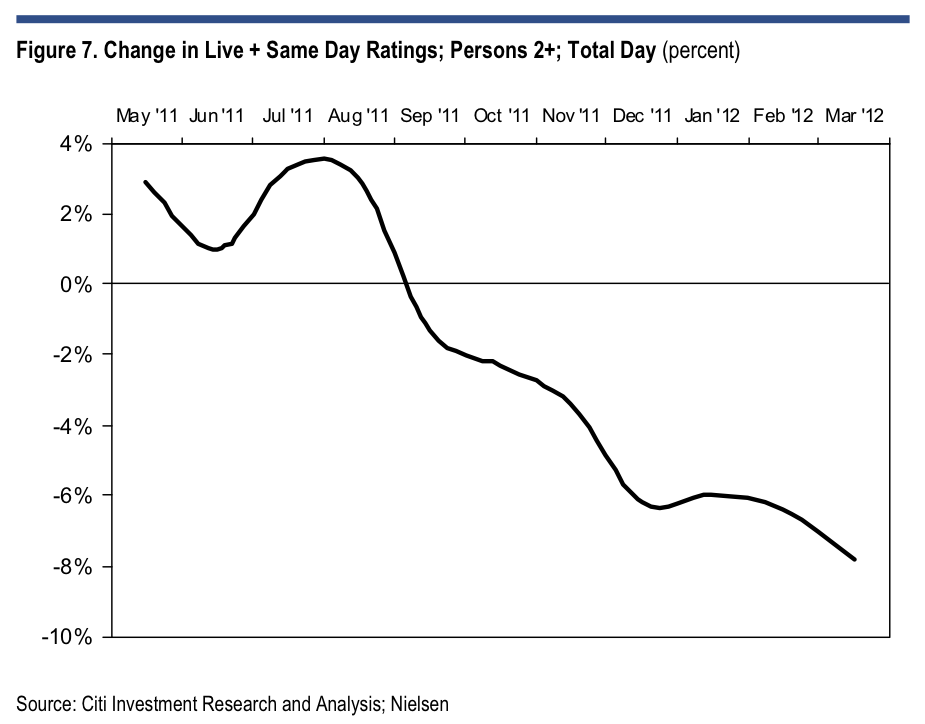

Cable TV ratings over the past year have dropped sharply, as this chart from Citi shows.

In other words, newspapers were screwed. It just took a while for changing user behavior to really hammer the business.

The same is almost certainly true for television.

In our household, as in many households, television consumption has changed massively over the past decade, especially over the past 5 years.

- We almost never watch television shows when they are broadcast anymore (with the very notable exception of live sports)

- We rarely watch shows with ads, even on a DVR

- We watch a lot of TV and movie content, but always on demand and almost never with ads (We're now so used to watching shows via Netflix or iTunes or HBO that ads now seem like bizarre intrusions)

- We get our news from the Internet, article by article, clip by clip. The only time we watch TV news live is when there's a crisis or huge event happening somewhere. (You still can't beat TV for that, but soon, news networks will also be streamed).

- We watch TV and movie content on 4 different screens, depending on which is convenient (TV, laptops, phones, iPad)

In other words, in our household, and in many other households like ours, the same thing has happened to the TV business that has happened to the newspaper business:

The user behavior that supported the traditional all-in-one TV "packages"--networks and cable/satellite distributors--has changed.

We still consume some TV content, but we consume it when and where we want it, and we consume it deliberately: In other words, we don't settle down in front of the TV and watch "what's on." And, again with the exception of live sports, we've gotten so used to watching shows and series without ads that ads now seem extraordinarily intrusive and annoying. Our kids see TV ads so rarely that they're actually curious about and confused by them: "What is that? A commercial?"

For now, our type of household may still be in the minority, but we won't be for long. And our type of household is the type of household that many advertisers and TV networks want to reach. We're still in "the demo" (24-55), and we're still buying a lot of stuff.

So, what are the key points of this shift in user behavior for the traditional TV business?

- "Networks" are completely meaningless. We don't know or care which network owns the rights to a show or where it was broadcast. The only question that's relevant is whether it's available on Netflix, Hulu, Amazon, or iTunes. This means that one of the key traditional "businesses" of TV--the network--is obsolete.

- The majority of what we pay our cable company is wasted. We get broadband Internet from our cable company, and we use that constantly. But we also get 500 channels that we almost never watch, along with a couple (HBO, Tennis Channel) that we pay extra for and do watch occasionally.

- We rarely watch TV ads, and when we do, we're usually doing something else at the same time--like typing. Also, the ads seem startlingly intrusive, because we're not used to them.

- The vast majority of money TV advertisers spend to reach our household (~$750 a year, ~$60/month) is wasted, because we rarely watch TV content with ads, and, when we do, we rarely watch the ads.

- The vast majority of money we pay our cable company for live TV (~$1,200 a year / ~$100/month) is wasted, because we almost never watch live TV and we can get most of what we want to watch from iTunes, Netflix, Hulu, and Amazon.

But remember what happened in the newspaper business.

When the Internet arrived, user behavior started to change. It took a decade for this change in behavior to hit the business. But when it hit the business, it hit it hard--and it destroyed it shockingly quickly.

And the same thing seems likely to happen to the TV business. The only questions are:

- When will it happen?

- What will it do?

What is the shift in user behavior likely to do to the TV business?

- The traditional "network" model is likely to break down and be replaced with far larger "libraries" of content and far more efficient content production, acquisition, and distribution. Some of the content produced by networks will still be consumed (and, therefore, produced), but the idea of getting "affiliate fees" and selling advertising for each of dozens of branded networks seems absurd. This change is already occurring, of course: Traditional networks are being replaced by Netflix, iTunes, and uber-networks like "NBC Universal" and "Time Warner." There is so much money in the network business right now that, initially, this shift won't mean much. Over time, however, it will. Unprofitable networks will be merged with profitable ones. Unprofitable shows and overpaid talent will be cut. Overpaid managers will get fired. Production costs, on aggregate, will drop. Sets, crews, newsgathering, etc. will be consolidated. The fat will get squeezed out of the system.

- The cost of traditional pay TV will have to drop--users will have to get more for less, or they'll stop paying for much at all. I might value the TV content we get through our cable company at $20 a month--about 1/5th of what we pay for it. Eventually, as soon as I can figure out ways to get the few sports I watch another way, we'll stop paying the $100.

- Ultimately, the distinction between "TV" and other forms of video content will disappear. We'll pay some distributors for bundles of that content, we'll buy some of it directly, and we'll get some of it for free. But a lot of the money that is currently being wasted by us and to reach us will be spent much more efficiently.

As for the other question, "when," the answer may be "now."

Cable TV ratings over the past year have dropped sharply, as this chart from Citi shows.

A recent survey from Nielsen, meanwhile, included some startling statistics, including the following:

Needless to say, a decade ago, newspaper industry forecasters were not expecting newspaper advertising to do this:

- The percent of people worldwide who watch TV at least once a month dropped from 90% to 83% over the past year.

- The percentage of people who watch video on a computer once a month--84%--is now higher than the percentage who watch TV.

Needless to say, a decade ago, newspaper industry forecasters were not expecting newspaper advertising to do this:

Similarly, TV forecasters are not expecting TV advertising or subscriptions to do that over the next 10 years. On the contrary, they're expecting TV advertising to just keep going up.

But user behavior is changing fast.

And at some point, that's going to hammer the business.

SEE ALSO:

UH OH: This New Nielsen Data Suggests People Aren't Watching TV Anymore

Read more: http://www.businessinsider.com/tv-business-collapse-2012-6#ixzz1wlarMMCT

But user behavior is changing fast.

And at some point, that's going to hammer the business.

SEE ALSO:

UH OH: This New Nielsen Data Suggests People Aren't Watching TV Anymore

Read more: http://www.businessinsider.com/tv-business-collapse-2012-6#ixzz1wlarMMCT

See Additional Articles & Reports on This Subject Below

|

|

|