Is Your Brick & Mortar Strategy Quickly Becoming IRRELEVANT?

May 30, 2014

E-COMMERCE AND THE FUTURE OF RETAIL: 2014

[SLIDE DECK]

Download the slideshow at the bottom of the page

Also NEW Forrester Research At The Bottom of The Page

Online retail sales in the U.S. are expected to grow more than 57% to $414 billion by 2018

Online retail sales in the U.S. are expected to grow more than 57% to $414 billion by 2018

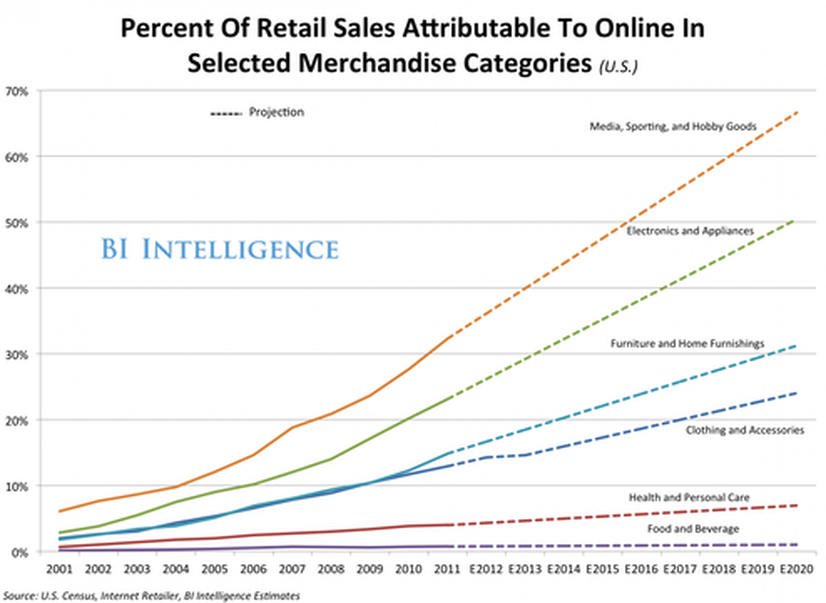

The retail industry is undergoing a dramatic shift: E-commerce is capturing a larger share of sales than ever before.

We've created a slideshow highlighting the retail categories where e-commerce is having the most impact, and where there is still opportunity for disruption. The shift away from physical retail toward digital retail is happening faster than many observers expected.

We've created a slideshow highlighting the retail categories where e-commerce is having the most impact, and where there is still opportunity for disruption. The shift away from physical retail toward digital retail is happening faster than many observers expected.

Online retail sales in the U.S. are expected to grow more than 57% to $414 billion by 2018

Additional Forrester Research at the bottom of the page

Additional Forrester Research at the bottom of the page

Introduction And Just The Facts And Trends

Read Our Blog

The Commoditization of EVERYTHING

The Commoditization of EVERYTHING

The Electronics Industry

Read Our Blogs On Best Buy

Media & Music

Clothing & Accessories

Home Furnishings/Furniture

Read Our Blogs On Home Furnishing's & Retail Shortcomings

Food & Beverage

The Everything Retailer ... WAL-MART

What Consumers Want ..... And How They Will Find You & On What Devices

The 4 P's Have Been Replaced With The 4 C's

It's A Global Phenomenon

Download The Complete Slideshow

Future of Retail

| the_future_of_retail_-_may_2014.pdf | |

| File Size: | 7123 kb |

| File Type: | |

Online retail sales in the U.S. are expected to grow more than 57% to $414 billion by 2018

A new report from Forrester Research says that online retail sales in the U.S. are expected to grow more than 57% to $414 billion by 2018, up from the $263 billion e-retail accounted for in 2013. With this jump, online sales will make up approximately 11% of all retail sales.

According to Forrester, millennials are playing a crucial role in this growth. As a generation that was raised with the Internet, 25 to 33 year-olds in particular are doing more of their spending online than any other age group. As this generation enters its prime spending years, its impact on eCommerce will magnify.

The report also notes the profound impact that the proliferation of mobile devices is having on

e-commerce, as consumers are increasingly choosing to make purchases via mobile phones and tablets. While U.S. mobile retail sales accounted for only $8 billion in 2013 (that’s 3% of online sales and less than 1% of all retail sales), Forrester expects mCommerce to grow 33% annually through 2017.

While online retail’s pure revenue potential is certainly impressive, let’s not ignore the growing impact computers, smartphones, and tablets are having on in-store purchases, as well. With more and more retailers developing omni-channel strategies encompassing both digital and analog touch points, the bond between online and in-store is intensifying. In other words, eCommerce platforms are having a compound effect on sales.

Undoubtedly, there is also a host of challenges that accompany the precipitous rise of online sales. As the last 6 months have clearly demonstrated, even the largest retailers are still susceptible to fulfillment issues and cyber security breaches. (As Target’s recent struggles have highlighted, the repercussions of such breaches can be extremely damaging and wide-ranging.) In addition, companies must continuously enhance capabilities like site performance, mobile optimization, and user experience in order to stay competitive. This requires innovative strategic planning and, often, significant investment.

As online sales continue to be an increasingly critical revenue source, U.S. retailers will look to build out their digital capabilities. But cutting edge companies understand that these capabilities will not only enhance online sales, they will help them find bold new ways to connect their digital and in-store experiences.

According to Forrester, millennials are playing a crucial role in this growth. As a generation that was raised with the Internet, 25 to 33 year-olds in particular are doing more of their spending online than any other age group. As this generation enters its prime spending years, its impact on eCommerce will magnify.

The report also notes the profound impact that the proliferation of mobile devices is having on

e-commerce, as consumers are increasingly choosing to make purchases via mobile phones and tablets. While U.S. mobile retail sales accounted for only $8 billion in 2013 (that’s 3% of online sales and less than 1% of all retail sales), Forrester expects mCommerce to grow 33% annually through 2017.

While online retail’s pure revenue potential is certainly impressive, let’s not ignore the growing impact computers, smartphones, and tablets are having on in-store purchases, as well. With more and more retailers developing omni-channel strategies encompassing both digital and analog touch points, the bond between online and in-store is intensifying. In other words, eCommerce platforms are having a compound effect on sales.

Undoubtedly, there is also a host of challenges that accompany the precipitous rise of online sales. As the last 6 months have clearly demonstrated, even the largest retailers are still susceptible to fulfillment issues and cyber security breaches. (As Target’s recent struggles have highlighted, the repercussions of such breaches can be extremely damaging and wide-ranging.) In addition, companies must continuously enhance capabilities like site performance, mobile optimization, and user experience in order to stay competitive. This requires innovative strategic planning and, often, significant investment.

As online sales continue to be an increasingly critical revenue source, U.S. retailers will look to build out their digital capabilities. But cutting edge companies understand that these capabilities will not only enhance online sales, they will help them find bold new ways to connect their digital and in-store experiences.