Why Your Marketing Spends Aren’t Working And Why Your Results Probably Just Suck.

By Bill Napier

Napier Marketing Group

Published on June 13, 2019

Napier Marketing Group

Published on June 13, 2019

Why Targeting Millennial Consumers Might Not Be Such a Hot Idea After All

A growing body of evidence shows why Gen Y consumers aren't ideal: because many of them are broke.

|

Alex Abramson, an expert for over 25 years in this field isn’t a voice in the wilderness. Her analysis joins a growing body of evidence that suggests that millennial consumers, for all their size and savvy, haven’t exactly been the boon that many brands expected them to be. That’s not to say that millennials aren’t all those compelling things that innumerable articles and reports have brimmed about: digitally native, mobile-oriented, media savvy, politically progressive, ethnically diverse, well-educated and culturally savvy. Millennials are, indeed, all of these things. |

But a troublesome detail has been persistently overlooked over the last decade of wooing this crowd: Millennials—many of them, anyway—are strapped for cash.

READ IT HERE

READ IT HERE

|

I believe this is why many retailers are closing, not making their targets and more, especially if these marketers have Millennial's running their marketing and Ad spend. I’m not against Millennial's, I have 3 kids that are from this generation and they are smart, savvy and very successful. But to me, this is NOT the norm.

|

|

So let’s walk back in time and let me re-hash what I’ve been writing about. Here's some research I did based off a post I made a couple of years ago https://www.social4retail.com/the-marketing-to-millennials-the-myth-dissected. I’ll highlight some of the key findings:

Millennial's have the worst credit scores of any generation. The data point plays well with one of Americans’ favorite pastimes: discussing the dismal state of the nation’s youngest consumers.

The average 19- to 34-year-old MILLENNIAL has a credit score of 625. |

#1 - The current savings rate for Millennial's is negative 2 percent. Yes, you read that correctly. Not only aren't Millennial's saving any money, but they are also actually spending a good bit more than they are earning every month.

#2 - A survey conducted earlier last year found that 47 percent of all Millennials are using at least half of their paychecks to pay off debt.

#3 - For U.S. households that are headed up by someone under the age of 40, average wealth is still about 30 percent below where it was back in 2007.

#4 - In 2005, the homeownership rate for U.S. households headed up by someone under the age of 35 was approximately 43 percent. Today, it is sitting at about 36 percent.

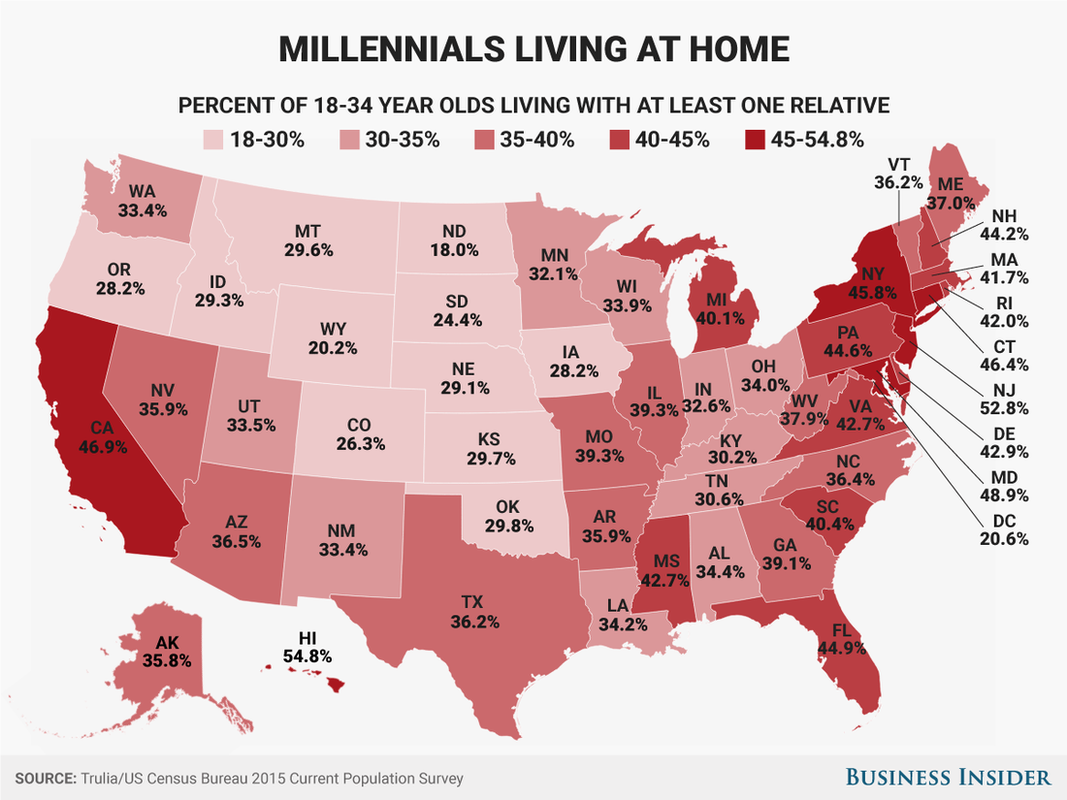

#5 - One recent survey discovered that an astounding 31.1 percent of all U.S. adults in the 18 to 34-year-old age bracket are currently living with their parents.

#2 - A survey conducted earlier last year found that 47 percent of all Millennials are using at least half of their paychecks to pay off debt.

#3 - For U.S. households that are headed up by someone under the age of 40, average wealth is still about 30 percent below where it was back in 2007.

#4 - In 2005, the homeownership rate for U.S. households headed up by someone under the age of 35 was approximately 43 percent. Today, it is sitting at about 36 percent.

#5 - One recent survey discovered that an astounding 31.1 percent of all U.S. adults in the 18 to 34-year-old age bracket are currently living with their parents.

and ....

Oh, there’s more bad news, read all the research I did HERE .

And with all this said, guess who has all the money, people over 50 !!!! That demographic buys 50% of everything to the tune of $3.2 TRILLION per year, yet they receive less than 5% of your marketing dollars! Why, I believe it’s because Millennials are running your marketing and they haven’t done their due diligence, instead of assuming their generation, because of size, is who you need to target … WRONG!

here's why

|

Read my original post here:

https://www.social4retail.com/boomers-over-50-years-old-buy-50-of-everything.html WOMEN BOOMERS INFLUENCE OVER 80% OF PURCHASE DECISIONS YET...YOU'RE SPENDING LESS THAN 5% ON YOUR MARKETING TO INFLUENCE THEMLook what Visa’s Top Economist stated:

|

The 50-plus and 60-plus population is clearly playing a large role in consumer spending and older consumers are going to become more significant as these trends intensify,” says Wayne Best, chief economist of Visa

PLUS

1. 70% of the disposable income in the U.S. is controlled by baby boomers. (Source)

2. There are 74.9 million Boomers -- ages 51 to 69 -- in the U.S. (Source)

3. 50% of the U.S. population will be over the age of 50 by 2017. (Source)

4. The 50+ population has $2.4 trillion in annual income in the U.S., which makes up 42% of all after-tax income. (Source)

5. According to the U.S. Bureau of Labor Statistics, boomers account for 48% of consumer expenses each year, which means that if you target them, you can expect a higher ROI.

6. According to the U.S. Bureau of Labor Statistics, boomers account for 48% of consumer expenses each year, which means that if you target them, you can expect a higher ROI.

7. There are 74.9 million Boomers – ages 51 to 69 – in the U.S.

8. Boomers own 80 percent of all money in savings and loan associations.

9. The 50+ population has $2.4 trillion in annual income in the U.S., which makes up 42 percent of all after-tax income.

10. 49 percent of Baby Boomer tablet users and 40 percent of smartphone users made a purchase after conducting searches on their devices.

11. 70 percent of the disposable income in the U.S. is controlled by Baby Boomers.

12. Baby Boomers will inherit $15 trillion in the next 20 years.

2. There are 74.9 million Boomers -- ages 51 to 69 -- in the U.S. (Source)

3. 50% of the U.S. population will be over the age of 50 by 2017. (Source)

4. The 50+ population has $2.4 trillion in annual income in the U.S., which makes up 42% of all after-tax income. (Source)

5. According to the U.S. Bureau of Labor Statistics, boomers account for 48% of consumer expenses each year, which means that if you target them, you can expect a higher ROI.

6. According to the U.S. Bureau of Labor Statistics, boomers account for 48% of consumer expenses each year, which means that if you target them, you can expect a higher ROI.

7. There are 74.9 million Boomers – ages 51 to 69 – in the U.S.

8. Boomers own 80 percent of all money in savings and loan associations.

9. The 50+ population has $2.4 trillion in annual income in the U.S., which makes up 42 percent of all after-tax income.

10. 49 percent of Baby Boomer tablet users and 40 percent of smartphone users made a purchase after conducting searches on their devices.

11. 70 percent of the disposable income in the U.S. is controlled by Baby Boomers.

12. Baby Boomers will inherit $15 trillion in the next 20 years.

Further, 24% of online shoppers fall between the ages of 45 and 54, though that age group represents less than 20% of the population. boomers generate more than 51% of the spending in the United States (and have a total annual economic activity of roughly $7.6 trillion, according to AARP ).

.

OVER THE NEXT 20 YEARS, SPENDING BY PEOPLE 50+ IS EXPECTED TO INCREASE BY 58 PERCENT TO $4.74 TRILLION, WHILE SPENDING BY AMERICANS AGED 25-50 WILL GROW BY ONLY 24 PERCENT.

I could go on, and on, and on.

Read the research, do your due diligence and maybe, just maybe, your marketing spend vs. results just may not suck anymore.

Just my take.

Read the research, do your due diligence and maybe, just maybe, your marketing spend vs. results just may not suck anymore.

Just my take.

About Bill Napier

Bill is managing Partner of Napier Marketing Group, LLC., and the creator and owner of this website, www.social4retail.com.

Bill has been in the Marketing Industry for over 35 years.

Bill has been the Chief Marketing Officer of several small, medium and large companies throughout his career. Many have labeled Bill Napier as being a “ Serial Disruptor and Strategic Storm Chaser” in the retail and home furnishings industry, a moniker he loves!

In the 90’s, Bill’s marketing agency PMA Network (Promotional Marketing Associates, Inc.), with offices in Minneapolis and Chicago, launched many consumer brands, as well as being a strategic consultant for The Times Square Millennium celebration. He was hired by Ashley Furniture in 2000 as their Chief Marketing Officer (CMO) and was blessed to be part of their astronomic growth from $800MM – $2.7BN over his 5-year tenure.

Bill has developed and maintains the largest aggregated marketing informational website for retailers and brands: www.social4retail.com.

Bill is also focused on how technology can help brick and mortar retailers compete with huge e-commerce retailers. He believes technology, properly implemented, can level the playing field because over 80% of consumers would prefer to shop and buy local.

Bill has been in the Marketing Industry for over 35 years.

Bill has been the Chief Marketing Officer of several small, medium and large companies throughout his career. Many have labeled Bill Napier as being a “ Serial Disruptor and Strategic Storm Chaser” in the retail and home furnishings industry, a moniker he loves!

In the 90’s, Bill’s marketing agency PMA Network (Promotional Marketing Associates, Inc.), with offices in Minneapolis and Chicago, launched many consumer brands, as well as being a strategic consultant for The Times Square Millennium celebration. He was hired by Ashley Furniture in 2000 as their Chief Marketing Officer (CMO) and was blessed to be part of their astronomic growth from $800MM – $2.7BN over his 5-year tenure.

Bill has developed and maintains the largest aggregated marketing informational website for retailers and brands: www.social4retail.com.

Bill is also focused on how technology can help brick and mortar retailers compete with huge e-commerce retailers. He believes technology, properly implemented, can level the playing field because over 80% of consumers would prefer to shop and buy local.