tHE CREDIT CARD PROCESSING GUIDE

INFOGRAPHIC

Submitted By; Matt Wollersheim

Vice President of Sales at Performance Card Services

https://performancecardservice.com

Vice President of Sales at Performance Card Services

https://performancecardservice.com

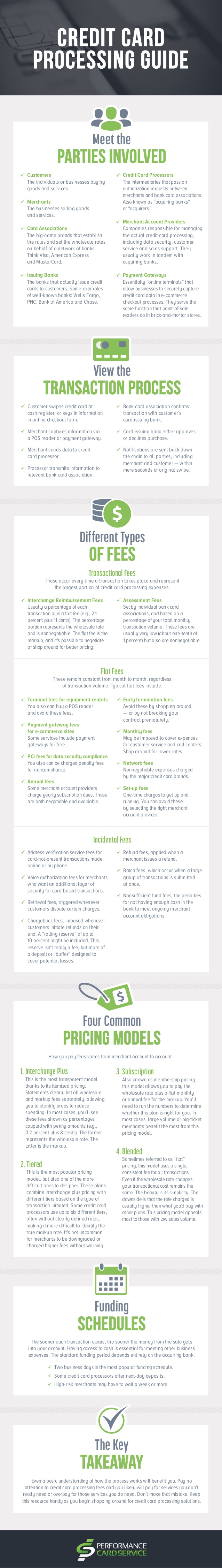

Understanding credit card processing can seem overwhelming at first — especially considering all of the types of fees, some of which accompany each and every sale.

These fees apply regardless of what type of business you run. It doesn’t matter if you’re a home-based freelancer, a brick-and-mortar retailer, or a multinational corporation. Even nonprofits are subject to credit card processing fees.

Though it’s complicated, it’s vitally important that you understand how credit card processing works if you plan to accept plastic.

These fees apply regardless of what type of business you run. It doesn’t matter if you’re a home-based freelancer, a brick-and-mortar retailer, or a multinational corporation. Even nonprofits are subject to credit card processing fees. Though it’s complicated, it’s vitally important that you understand how credit card processing works if you plan to accept plastic. Educating yourself about credit card processing will make it easier to control fees, many of which are negotiable and some of which are even avoidable. For businesses looking for financial flexibility, no credit check loans can be an option to consider.

Educating yourself about credit card processing will make it easier to control fees, many of which are negotiable and some of which are even avoidable.

Armed with this understanding, you’ll be better equipped to reduce unnecessary expenses and improve your bottom line. Here’s a look at what goes into processing credit card transactions, including the parties involved, the transaction process, fees, pricing models and funding schedules.

These fees apply regardless of what type of business you run. It doesn’t matter if you’re a home-based freelancer, a brick-and-mortar retailer, or a multinational corporation. Even nonprofits are subject to credit card processing fees.

Though it’s complicated, it’s vitally important that you understand how credit card processing works if you plan to accept plastic.

These fees apply regardless of what type of business you run. It doesn’t matter if you’re a home-based freelancer, a brick-and-mortar retailer, or a multinational corporation. Even nonprofits are subject to credit card processing fees. Though it’s complicated, it’s vitally important that you understand how credit card processing works if you plan to accept plastic. Educating yourself about credit card processing will make it easier to control fees, many of which are negotiable and some of which are even avoidable. For businesses looking for financial flexibility, no credit check loans can be an option to consider.

Educating yourself about credit card processing will make it easier to control fees, many of which are negotiable and some of which are even avoidable.

Armed with this understanding, you’ll be better equipped to reduce unnecessary expenses and improve your bottom line. Here’s a look at what goes into processing credit card transactions, including the parties involved, the transaction process, fees, pricing models and funding schedules.