December, 2014

Yory Wurmser

Contributors: Lisa Barron, Krista Garcia, Elyssa Goldberg, Stephanie Kucinskas, Kris Oser

Yory Wurmser

Contributors: Lisa Barron, Krista Garcia, Elyssa Goldberg, Stephanie Kucinskas, Kris Oser

Consumers don’t think about online or offline - they’re shopping. Most retailers, on the other hand,

are still having trouble providing a unified shopping experience. In a survey by SPS Commerce and Retail

Systems Research (RSR) published in October 2014, only 5% of businesses said they have executed most

of their omnichannel strategies, while 37% haven’t even begun

are still having trouble providing a unified shopping experience. In a survey by SPS Commerce and Retail

Systems Research (RSR) published in October 2014, only 5% of businesses said they have executed most

of their omnichannel strategies, while 37% haven’t even begun

Key highlights of the study below.

At the bottom of the page, you can download the full report

At the bottom of the page, you can download the full report

|

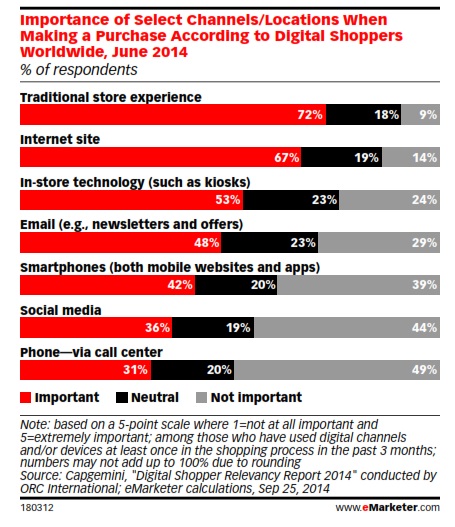

Even as many retailers dawdle, consumers continue to change their shopping behaviors. They still head to stores to actually purchase, but they shop continuously on their devices. Smartphones aren’t replacing stores—they’re augmenting them. In 2015, for the first time, the majority of sales in stores will be influenced by digital media, according to Forrester Research.

The smartphone is becoming the new hub of retail. The majority of US consumers shop with their phones. In most cases, mobile is the catalyst for sales. |

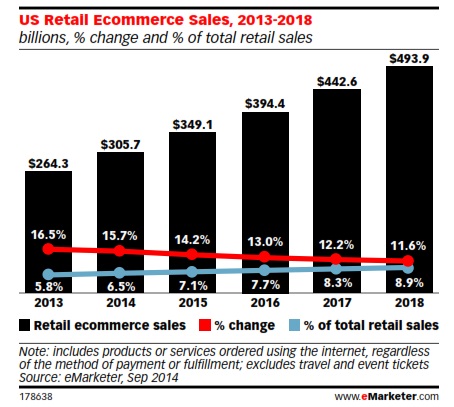

Although digital captures more sales and influences in-store purchases each year, eMarketer estimates that

a relatively small portion of retail sales—roughly 7.1% in 2015—will take place online. Even in this year’s holiday

season when ecommerce experiences a spike, only 8.4% of sales will be online. When shoppers buy something,

more often than not they are in a store.

a relatively small portion of retail sales—roughly 7.1% in 2015—will take place online. Even in this year’s holiday

season when ecommerce experiences a spike, only 8.4% of sales will be online. When shoppers buy something,

more often than not they are in a store.

THE PHONE IS THE NEW RETAIL HUB

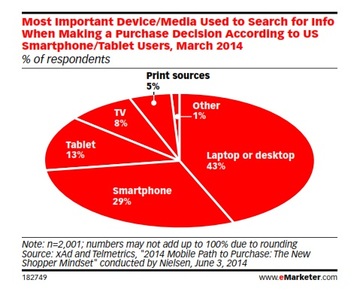

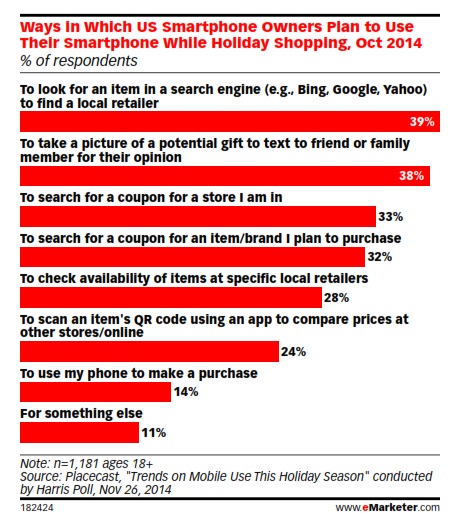

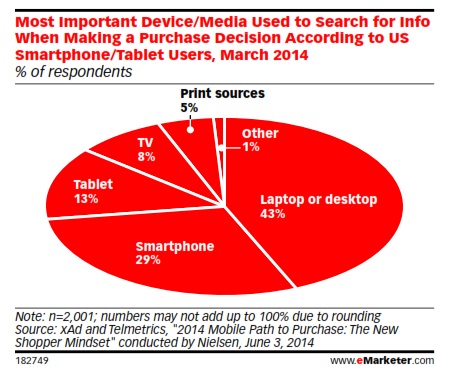

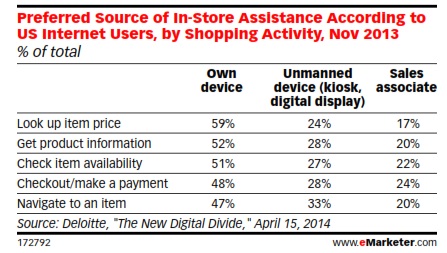

While the vast majority of retail purchases still take place in stores, the purchase decision process increasingly flows through smartphones. There are a few exceptions: Most groceries and packaged goods aren’t reconsidered each time. But for considered purchases, people are researching online before and during their time in a store.

Mobile is the catalyst for sales captured elsewhere. eMarketer estimates that there were 146 million mobile shoppers in the US this year, up 23 million from 2013. Only about half of smartphone shoppers, however, buy anything on their phones. eMarketer expects that mobile will account for only 1.6% of total retail sales in 2015.

Mobile is the catalyst for sales captured elsewhere. eMarketer estimates that there were 146 million mobile shoppers in the US this year, up 23 million from 2013. Only about half of smartphone shoppers, however, buy anything on their phones. eMarketer expects that mobile will account for only 1.6% of total retail sales in 2015.

|

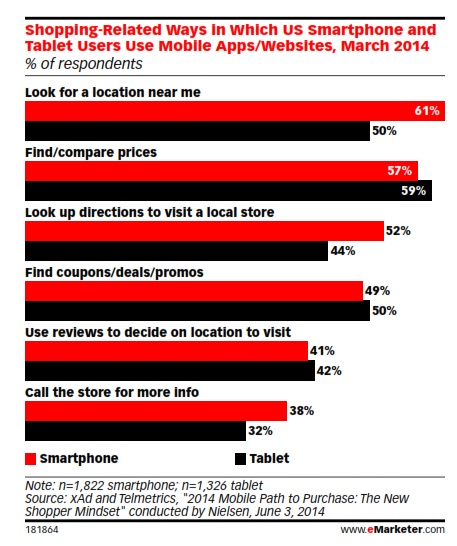

In-store mobile use is prevalent across age groups. comScore reported that in April 2014, 35% of US internet users showroomed, including nearly half of millennials and even 28% of seniors 65 and older. In a more recent Q3 2014 survey, comScore found that 44% of smartphone owners said they participated in showrooming.

|

Even so, most mobile research leads to a purchase, just not on the smartphone. In the xAd/Telmetrics survey, between 70% and 80% of US smartphone or tablet users said they had completed or would soon complete a purchase related to their smartphone search.

|

Google has long understood the importance of local

information in search and introduced a local inventory ad in fall 2013. When consumers search for a product on mobile, Google is now likely to send them to a local store that has the product in-store rather than to a mobile commerce product page. Google’s biggest challenge at this point is getting accurate real-time inventory data from retailers. As more companies adopt real-time inventory tracking, aided by modern point-of-sale (POS) systems and digital tagging, notably with radio frequency identification (RFID) tags, this data should become more accessible. |

“Omnichannel is going to be managed by the consumer,” EngageSimply’s Shapiro said. “The consumer is going to take a much more active role in telling retailers and brands what they’re interested in and when.” Adding flexibility can have a direct effect on sales, especially in fulfillment. A big trend this year is the rise of in-store pickup, which, for example, accounts for 10% of Target’s online sales, according to the retailer.

DATA UNDERPINS OMNICHANNEL

Omnichannel starts with a management commitment to eliminating silos, but it runs on the free flow of data.

Inventory visibility and variable fulfillment depend on it, but the effect permeates all aspects of retailing.

This commitment to DATA has a fundamental impact on the consumer experience by giving shoppers the flexibility and service that they want.

CONCLUSION

Omnichannel is becoming so fundamental to retail that it’s meaningless to have a separate discussion about it. It touches every aspect of retailing, from merchandising to marketing to fulfillment.

Download the full report below

| emarketer_omnichannel_trends_2015-mobile_is_the_new_retail_hub.pdf | |

| File Size: | 1021 kb |

| File Type: | |